Articulating the Story Behind Investment Decisions (& the benefits of facilitation)

For most organisations, real estate transactions are a means to an end. The decision making process leading to buying, selling, letting or constructing operational space follows the identification of a problem;

“we need more space”

“we have too much space”

“we need to expand into that region”

“we are not getting the best out of our assets”

In some form or another, that investment decision will require a business case; that is, a justification for initiating a project or programme which provides decision makers and stakeholders with a proven framework for structured thinking.

There is no doubt that the rigour of the five case model used for government funded investments is equally applicable to any proposed capital investment in the private and third sector where shareholders and stakeholders demand demonstrable robust decision making.

The Problem with Problems

The common problem, however, in our experience, is that often the horse has already bolted, where the business case is produced to justify an outcome which has already been cemented based on little more than a hunch or an obvious solution. Before identifying the true problem, project sponsors are already wedded to a course of action, and the business case is seen as little more than an administrative exercise to obtain funding.

The key to the success of any investment decision is to fully explore and identify why the investment is required in the first place in order to arrive at a compelling and robust proposal.

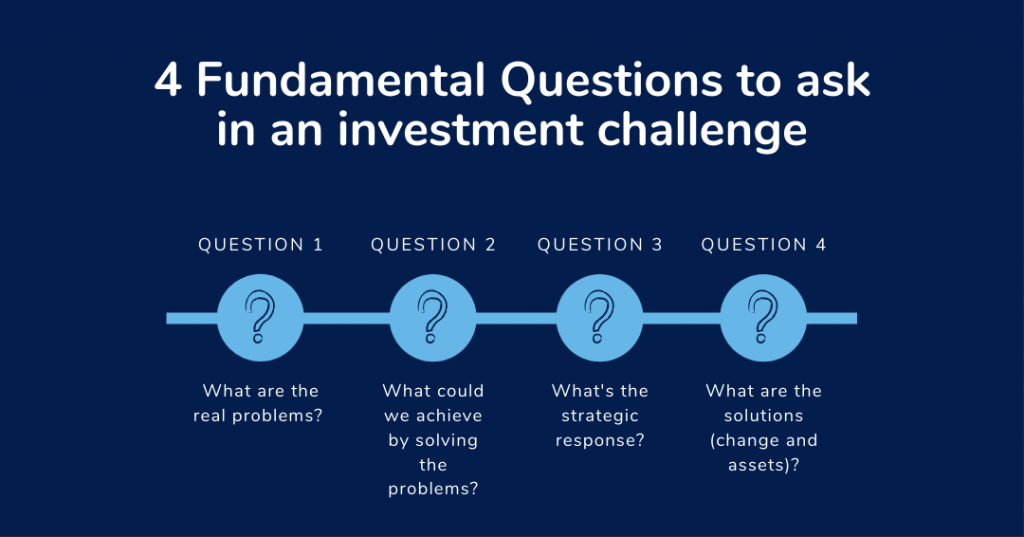

This is rarely as straightforward as it sounds, and third party facilitation is a recognised process for helping organisations to frame the four fundamental questions that need to be answered in any investment challenge:

An experienced facilitator brings objectivity to the processes of thinking in terms of problems and benefits, drilling down into the ‘whys’ and ‘what ifs’ with impartiality, and applying discipline to the procedure ensuring that the final investment proposal focusses on the underlying cause.

This is a critical first step in the process of developing an objective business case, where potential options (solutions) are not brought into the equation until the underlying drivers for investment have been fully explored.

A valuable tool developed in government organisations in Australia and New Zealand is called investment logic mapping (ILM). An investment logic map is used to tell the logical story underpinning any proposed investment. It represents the agreed investment story that is created from informed discussions through facilitated workshops. The output is written in plain English so that it can be understood by a layperson.

The benefit of developing an ILM is that it changes the way we think about a project. So often we have a solution and then design a project without having a deep and shared understanding of the underlying problems. An ILM forces the investor (sponsor) and stakeholders to think about what the problems are and how best to respond to these strategically before specific solutions are identified.

At CSquared we are experienced in facilitation, the ILM process and in producing business cases. We have led the process at central and local government level, and in the third and private sector. Please get in touch – mark.evitts@csquaredre.co.uk / 01225 904704 -for an informal discussion about how we can add value to your problem solving and investment decision making processes.